Overwhelmed by Financial Decisions?

Let Your Personalized CFO Simplify Your Path

Financial advisor in Scottsdale and Phoenix providing flat fee-only, fiduciary investment management, retirement planning and financial planning.

Financial advisor in Scottsdale and Phoenix providing flat fee-only, fiduciary investment management, retirement planning and financial planning.

Are These Questions Keeping You Up At Night?

Serving Families Since:

Financial advisor in Scottsdale and Phoenix providing flat fee-only, fiduciary investment management, retirement planning and financial planning.

2012

CFP® Since:

2016

Clients Served:

1,000+

and counting

In the Press:

Simplifying Your Financial Plan

Free Resources

Want to see what my clients have to say?

These testimonials were provided by clients of Singh PWM LLC. The clients were not compensated, nor are there material conflicts of interest that would affect the given statements. The statements may not be representative of the experience of other current clients and do not provide a guarantee of future performance, success or similar services.

Don’t feel ready to work with an advisor?

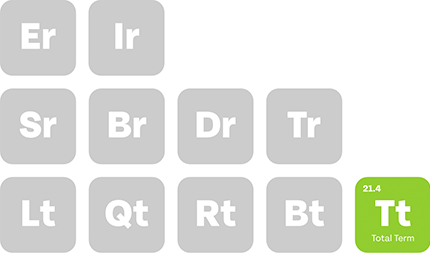

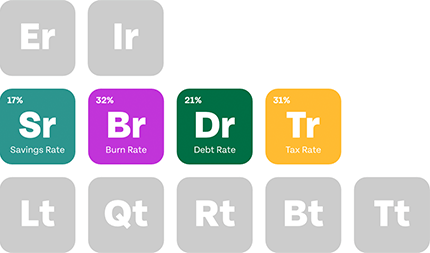

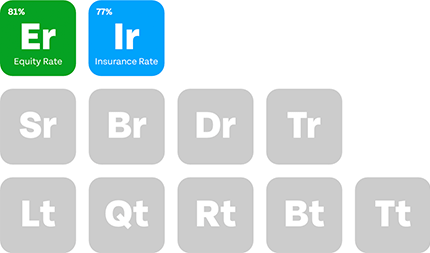

Break down your financial problems into Financial Vitals

Your Financial Vitals Bloodwork Report

A Financial Vitals Snapshot is your Financial “Bloodwork” Report that shows you exactly where you are, where you're going, and the vitals you should be working on improving.

By reviewing the Top 10 Financial elements of your report, you can see your current status of your financial vitals and future direction to make improvements as necessary.

With over 12 years of industry experience, a selection of 10 hand-picked key metrics can determine your financial health, highlighting the areas you should focus on improving.

Flat-fee, fiduciary financial advisor serving Scottsdale and Phoenix, specializing in investment management, retirement planning, and comprehensive financial planning

Here’s how the Financial Vitals Report helps you

Get sample experience of how Your Personalized CFO can help

Serving Scottsdale and Phoenix, our flat fee only fiduciary financial advisory firm offers expert investment management, retirement planning, and personalized financial planning services

A Financial Snapshot is your Financial “Bloodwork” Report that allows us to get to know you and provide some general feedback on your situation at no cost to you!

Valued at $1,000

4 Steps and 10 Minutes Of Your Time

Step 1: Click the “Get Your Free Financial Fitness Bloodwork Report” Link Below

Step 2: Follow the instructions to answer questions to generate your Financial Vitals Bloodwork Report

Step 3: Receive a Personalized Video on findings & recommendations

Step 4: Option to book a Free 30-minute follow-up meeting with your questions

Hi, I’m Raman, and my story starts in India, where life wasn’t easy. When I was just 12 years old, my parents made a difficult decision to send me to Texas to live with my grandparents. They wanted me to have a chance at a better future, but it wasn’t simple. I found myself in a small apartment, sharing space with eight family members, where money was tight, and every dollar mattered.

Those early days taught me something important: no matter how little you have, planning for the future makes all the difference.

As I grew up, I worked hard to make sure I wasn’t a burden to my family. I held three jobs while putting myself through college, studying Finance at the University of Houston. A mentor, Mike Cook, gave me a life-changing opportunity to intern at Morgan Stanley. That was the start of a 13-year journey where I worked at firms like Fidelity and Facet Wealth, eventually earning my Certified Financial Planner™ designation in 2016.

But along the way, I saw things I couldn’t ignore. Too many financial advisors were focused on selling commission-based products or charging high fees without really helping people understand their money. I saw how confusing and unfair the system could be for regular people—people like the ones I grew up with, who just wanted someone to guide them, honestly and transparently.

So in 2023, I started my own firm, built on the values I hold close. As a flat fee-only fiduciary, I don’t sell products or take commissions. I don’t charge a percentage of your investments. Instead, I charge a flat fee and focus on what truly matters—helping you plan, teaching you along the way, and being there to support you through life’s changes.

Whether you’re buying your first car, saving for your child’s education, or preparing for retirement, I’ll be your partner in making those dreams a reality.

I’m a husband, soon-to-be father, and someone who feels deeply grateful for the chance to use my experience to help others. My mission is simple: to do what’s right and to help you build the future you deserve.

Raman Singh

Certified Financial Planner™

Your Personalized CFO

"Serving others is the purest and most fulfilling form of satisfaction in life."

Services & Fees

Holistic Planning

$3,600 Per Year

✓ Initial Holistic Plan Snapshot

✓ Consumer Debt & Student Loan Planning

✓ Unlimited Access to Holistic Planning Platform

✓ Proactive Educational Resources, Webinars Access, Newsletters, Fitness Challenges

✓ Semi-Annual Financial Plan Snapshot Updates

✓ Quarterly Virtual Planning Meetings

✓ Risk Identification Planning

✓ Personalized Financial Plan

✓ Investment Management Services**

✓ Employer Benefits Analysis

✓ Investments Review & Recommendations for Self-managed Investors

✓ Insurance Needs Analysis

✓ Education Planning

✓ On Demand Support for Major Life Changes and Events

✓ Tax Planning Strategies

✓ Flat Fee-only Fiduciary Advice

Tax Planning Strategies for Personal Taxes Only which includes Employer Stock Planning. For Business Taxes and Business Tax Planning, there will be a surcharge and potentially outsourcing of work.

Investment Management Services for any portfolios under $1,000,000 for Holistic Planning included in the fee.

Tax Preparation Services Available for additional cost

Estate Planning Documents Preparation Services Available for additional cost

Flat Investment Management Fee

$3,600 Per Year

Assets up to $1,000,000

——————————————————————————

$6,000 Per Year

Assets From $1,000,000 - $1,999,999

——————————————————————————

$8,000 Per Year

Assets From $2,000,0000 - $4,999,999

——————————————————————————

$12,000 Per Year

Assets From $5,000,000+

——————————————————————————

✓ Initial Holistic Plan Snapshot

✓ Unlimited Access to Holistic Planning Platform

✓ Semi-Annual Virtual Planning Meetings

✓ Risk Identification Planning

✓ Personalized Financial Plan

✓ Investment Management Services

✓ Insurance Needs Analysis

✓ On Demand Support for Major Life Changes and Events

✓ Tax Planning Strategies

✓ Flat Fee-only Fiduciary Advice

Hourly Project Rate @ $250 Per Hour

Providing fiduciary financial planning, retirement strategies, and investment management with a flat fee only structure for clients in Scottsdale and Phoenix

So are you ready for a Personalized CFO in your life?

Share your thoughts